Walmart sales tax calculator

To calculate the amount of sales tax to charge in Los Angeles use this simple formula. Youll use this list to complete Item Setup BUT do not need it to.

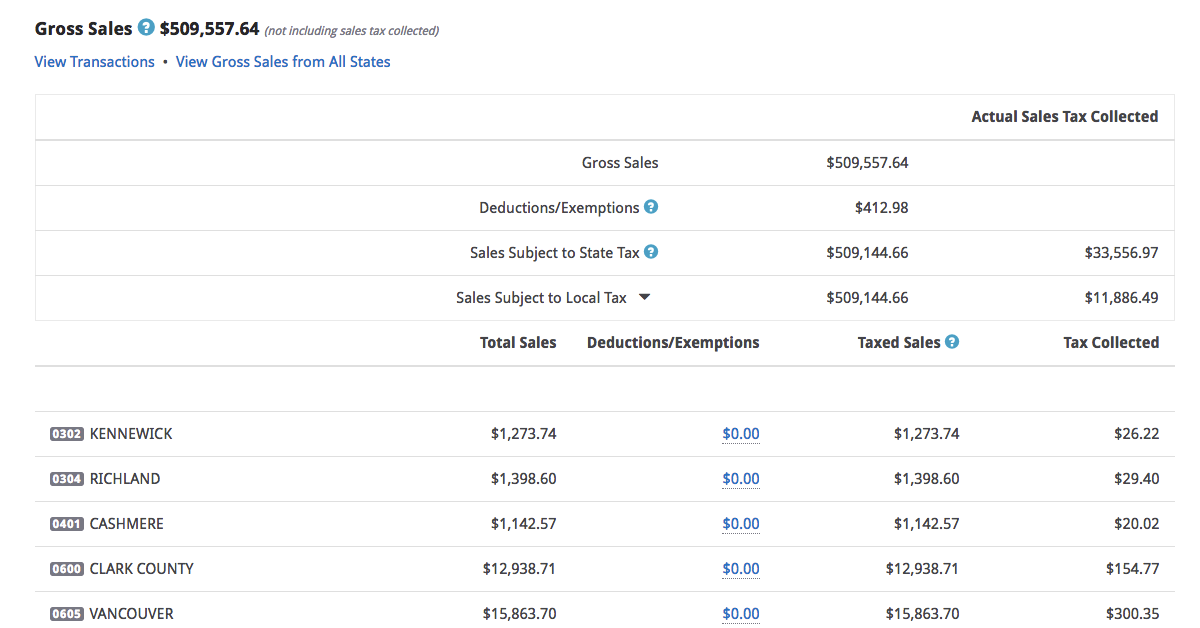

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar

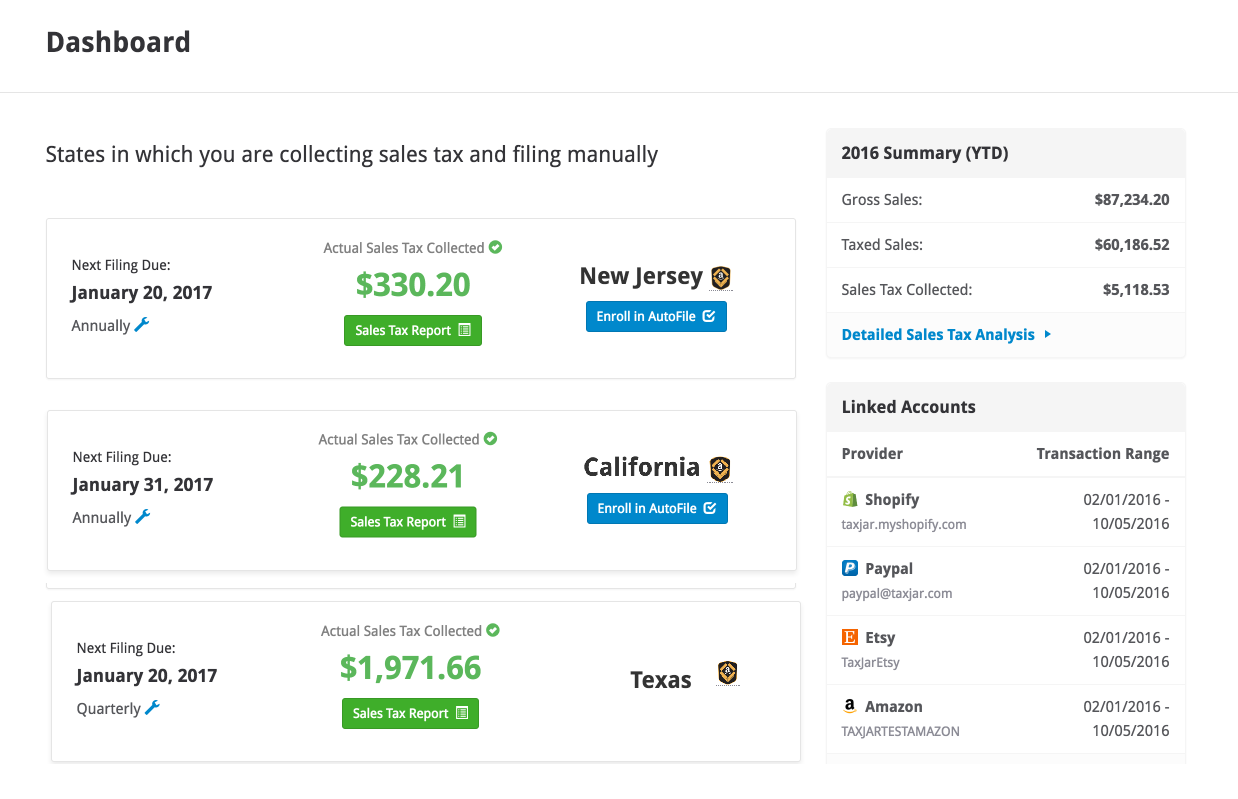

Filing and remitting sales tax for your Walmart store has never been easier.

. Sales tax rate sales tax percent 100 Sales tax list price sales tax rate Total price including tax list price sales tax or Total price including tax list price list price sales tax rate or. Buy products such as Texas Instruments TI-30X IIS Scientific Calculator 10-Digit LCD at Walmart and save. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The prices and taxes are calculated based on the state of the customer and. Download the current Sales Tax Codes for Walmart Marketplace by clicking below. Please visit our State of Emergency Tax Relief page for additional information.

For instance in Palm Springs California the total. The price and tax calculation is based on the state of the customer and seller the sales tax policies of the seller and local and state laws. Enter the sales tax percentage.

Accuracy guaranteed With economic nexus determination and guaranteed accurate calculations TaxJar ensures you. If youd like to calculate sales tax with product exemptions sourcing logic and. Like the federal tax rate the California tax rate is different for each type ie the California sales tax rate is 725 the rate of the estate tax is 40 and it is varied for the income tax.

Calculate the amount of sales tax and total purchase amount given the price of an item and the sales tax rate percentage. Enter the total amount that you wish to have calculated in order to determine tax on the sale. The exact amount of tax charged is.

Walmart executes its Algorithm for price calculation and Tax counting for the customers at the time of check out. More about shipping sales tax codes. Purchase Amount Purchase Location ZIP Code -or-.

Businesses impacted by recent California fires may qualify for extensions tax relief and more. Sales tax total amount of sale x sales tax rate in this case 95. Handbook of Mathematical Functions.

Or to make things even easier input. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. Skip to Main Content.

To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate. Sales tax is calculated by multiplying the purchase price by the sales. Sales Tax Calculator Enter your city and zip code below to find the combined sales tax rate for a location.

Up to 4 cash back Shop for Calculators in Office Supplies.

Eight Percent Sales Tax At Wal Mart Coastal Courier

Walmart Integration Taxjar

How To Charge Your Customers The Correct Sales Tax Rates

2nd Tax On Receipts Confuses Customers At New Walmart Youtube

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar

Sales Tax On Grocery Items Taxjar

Sales Tax Calculator Taxjar

Understanding California S Sales Tax

Eight Percent Sales Tax At Wal Mart Coastal Courier

Sales Tax Calculator Taxjar

Sales Tax Calculator Taxjar

How To Charge Sales Tax In The Us 2022

Ebay Taxes An Overview Guide Quickly Learn Everything You Need To Know

How To Charge Your Customers The Correct Sales Tax Rates

Taxjar Woocommerce

How To Calculate Sales Tax For Your Online Store

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar